Before the pandemic, China was the top global spender on outbound tourism, accounting for 20% of international tourism spending, with $277 billion spent in 2018 and $255 billion in 2019. Although the pandemic has affected the outbound tourism market, the recovery has reached 69% of 2019 levels in Q1 of 2024, indicating a significant rebound from the previous year.

Affordable airfare and easy visa requirements are two key factors driving China's interest in the Middle East, attracting Chinese tourists seeking to immerse themselves in the region's rich cultural heritage. According to iPinYou data, over 2 million trips were made from China to the Middle East in the last 12 months, with 1.5 million confirmed trips scheduled to take place in the next 6 months. Major Middle Eastern countries, such as Saudi Arabia, recognized China as a significant source of foreign visitors with vast market potential and opened their doors to Chinese tourists in 2019. Iran also began offering visa-free privileges to Chinese tourists in the same year, further attracting visitors from China. The United Arab Emirates (UAE), Egypt, Morocco, and Israel emerged as the top travel countries in the region for Chinese travelers during this period.

What will the Chinese do when they travel to the Middle East?

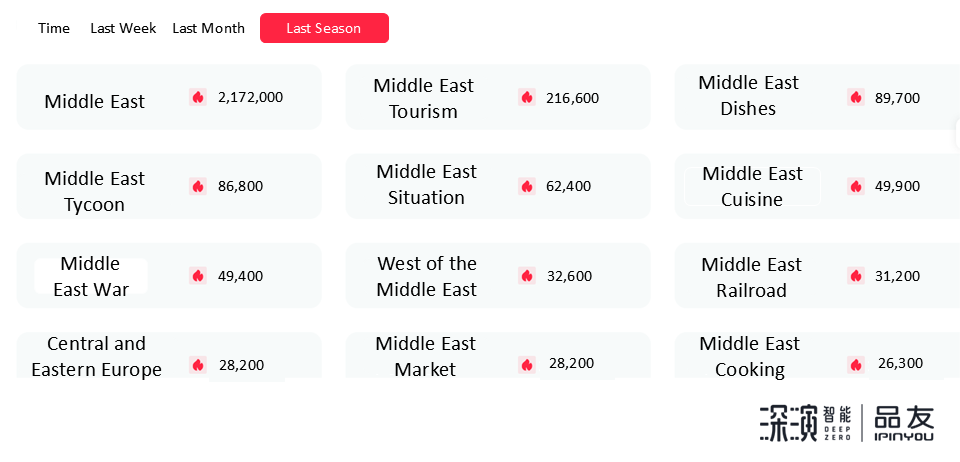

China's most popular social media platform, xiaohongshu, has seen the keyword "Middle East" searched 2.172 million times in the last three months, with "Middle East Travel" and "Middle East food" being the most searched relevant words. This indicates a significant interest among Chinese netizens in Middle Eastern culture and cuisine.

Egypt has experienced a significant increase in Chinese tourists, with iPinYou data showing 557,000 trips from China to Egypt in the last 12 months. Egypt-related posts on Xiaohongshu received 158.3 million likes in July, with the exhibition of Egyptian artifacts at the Shanghai Museum accelerating the popularity of this topic. Users search for travel spots, visa application methods, and share their travel experiences and plans in Egypt. Riding a hot air balloon is a popular activity that almost every Chinese tourist visiting Egypt plans to experience. Additionally, posts sharing dressing styles during the trip that will make the photo look stunning are also welcomed.

As China and several Middle Eastern countries strengthen their industrial and investment cooperation, China has become the UAE's third-largest source of investment, covering various fields such as real estate, logistics, warehousing, and finance. This year, Dubai has seen an influx of Chinese companies, and Dubai Mall has opened a Chinatown featuring Chinese elements and brands like Haidilao and Xiaomi. Several Middle Eastern countries offer a good business environment and security, with many investment opportunities and tax incentives that attract Chinese companies to invest and set up operations there.

With the booming development of the tourism market and the promotion of the "Belt and Road" initiative, China is gradually becoming an important participant in the Middle Eastern real estate market and local economic activities. Investors are increasingly drawn to the region's real estate market, particularly Dubai, which has a resilient and stable property market that has attracted Chinese investors looking for secure long-term investments. According to global real estate services provider Savills, Dubai's real estate market has witnessed a significant rise in Chinese investment, with transaction volumes increasing by 35% in the last quarter, resulting in a record-breaking number of 35,100 units being traded. To stay informed and up-to-date, Chinese investors are turning to social media platforms such as Douyin and Xiaohongshu for more information and insights.

How to Precisely Target Affluent Chinese Travellers

When venturing abroad, Chinese travellers encounter numerous factors that affect their decision-making process and overall travel plan. The internet is the main source of information for outbound tourists. Before traveling abroad, tourists mainly search for transportation information, followed by accommodation information, tourist price information, and local culture and customs.

As of December 2023, there are 1.092 billion internet users in China, with an internet penetration rate of 77.5%. Chinese users spend an average of 26.1 hours per week using the internet, with access to 3.88 million websites and 2.61 million relevant apps. The number of mobile websites visits comprises around 99.9% of total web traffic. Although these statistics provide a vast potential for digital marketing, numerous channels pose difficulty when precisely targeting.

In contrast to Western internet users, who trust the sites they visit, Chinese consumers tend to be more cautious and frequently scrutinize sites for fraudulent sources offering substandard merchandise. Therefore, they meticulously research their online options and compare more extensively before deciding. Marketing strategies compasses these unique differences. To succeed in China, companies must make a positive and expeditious impression on consumers and emphasize particular affiliateiative factors that influence their intended Chinese audience. Gaining brand recognition and embodying uniqueness is the key to attract visitors and could be achieved by iPinYou Optimus DSP's targeted advertising on platforms such as social media, CTV, OTT, and mobile apps/websites.

Optimus DSP enhances customer engagement on major Chinese apps through PDB, PD, and RTB, enabling cross-app activation across social, video, news, tools, and podcasts. It also supports cross-device activation on mobile and OTT/CTV. As an advanced self-serve DSP, it offers third-party reporting and safeguards brand safety for each impression.

Build Your Target Audience with China Audience Data and Marketing Technology through Optimus DSP

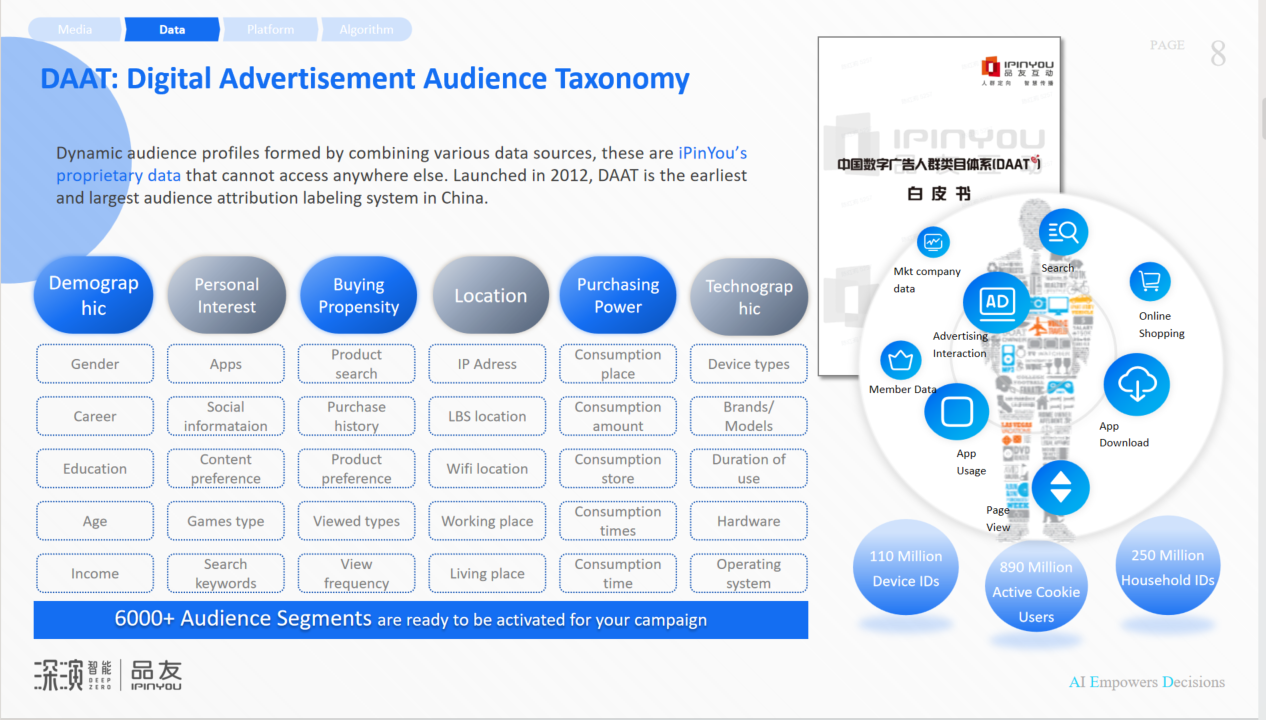

- Demographic: According to the "China Outbound Tourism Development Report (2023-2024)" released by the China Tourism Academy, the number of outbound tourists from China exceeded 87 million in 2023, and it is expected to reach 130 million in 2024. The survey shows that the majority of outbound tourists are young and middle-aged, with the 22-41 age group accounting for as high as 82.8%. The proportion of outbound tourists with undergraduate and college degrees is the highest, accounting for about 74.36% in total. Among the occupations of outbound tourists, freelancers have the highest proportion, and tourists with medium income and those from first and second-tier cities have a more positive attitude towards traveling. The audience can be immediatly activated by iPinYou DAAT tagging system with 6000+ dynamic China audience segments data ready to be used for your campaign.

- Interest: Outbound tourists are more concerned about transportation convenience and local prices, and they are looking forward to new and unique experiences. In terms of accommodation, tourists have shifted their preference from mid-range hotels to budget hotels, with nearly half of the respondents choosing to stay in budget hotels. One-third of outbound tourists chose mid-range hotels, and the proportion of tourists choosing luxury hotels has decreased.

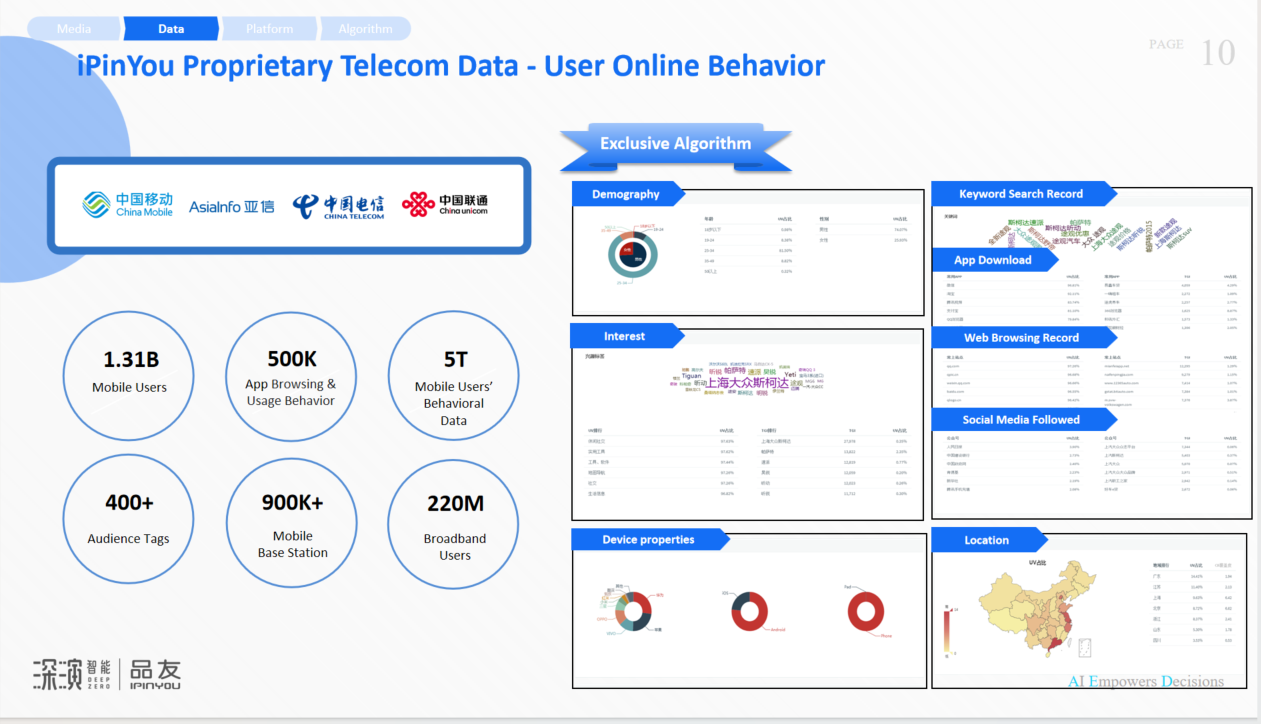

- Behavior: The Chinese used to book their travels on top OTAs like Crips, Fliggy and Tongcheng, and search for travel spots on social media. In order to engage with travellers as they start planning, Marketers can use iPinYou Telecom Carrier data to target users who frequently use OTA and vertical specific apps, and users who search for relevant terms and followers of designated social media accounts.

China Civil Aviation Data (CAD) collects the confirmed travel details from each transaction from all OTAs, travel agencies and direct bookings and shares the anonymous ticket details with iPinYou. By matching the CAD with the China audience telecom device IDs, we are able to precisely target travellers who have bought airtickets to your cities.

Tips to Raise Your Ads' Performance in China

- Allocate more budget to the media with better performance in terms of traffic quality and CTR.

Under such fragment of the internet media landscape, what channels should brands choose for advertising? In accordance with the latest data of China individuals using the internet (CNNIC, 2023), top 5 user size apps types are Online video (including short video) (97.7%) , Instant Messaging (97%), Short Video (96.4%), Online Payment (87.3%), Online Shopping (83.8%). The number of users of online car hailing, online travel booking, online shopping, live streaming and Internet medical care increased by 90.57 million, 86.29 million, 69.67 million, 65.01 million and 51.39 million or 20.7%, 20.4%, 8.2%, 8.7% and 14.2%, respectively. Brands can utilize the media list we created, placing ads either independently through the Optimus DSP system or with our assistance.

- Choose app types in different stage based on user journey

Most Chinese rely on Apps to get travel inspiration, make plans, book airtickets and hotels, and share experiences. In the planning stage of the user journey, most people first think of using Xiaohongshu to make travel guides, followed by various search engines, Douyin and OTA platforms. Many countries have partnered with Ctrip, Ant Group, and Fliggy. Tourists can book various services on OTA platforms. During the trip, they prefer to use OTAs for checking flight information, and use tool apps, such as payment, translators, cameras, maps, weather apps, to assist with the entire journey.

- Find effective ad formats and allocate more budget

To effectively reach Chinese travelers, the first step is to attract their attention. We firstly recommend using ad formats that have 100% share of voice and viewability, such as the opening screen format, which is the initial ad that users see when they enter their preferred app. Following that, we suggest running native formats that allow for headlines and descriptions to provide more information about any deals or offers that may drive conversions. Video ads are also an excellent way to engage with users, as pre-roll video ads in China are non-skippable, giving brands the opportunity to engage with users for 15 or 30 seconds before they watch their chosen video content on apps or connected TV. Additionally, audio and podcast advertising offers 30-second pre-roll audio ads. Platforms like Himalaya and Dragonfly FM enable brands to target users who listen to travel podcasts, providing a great opportunity to build awareness among these audiences. By utilizing a combination of these ad formats, brands can effectively capture the attention of Chinese travelers and drive conversions.

- Retarget audiences to enlarge the audience pool size

It is recommended to use data from previous ad campaigns to identify users who have already engaged with your brand and target them with new ads. This can involve creating custom audiences based on user behavior, such as those who have clicked on previous ads or visited your website. By retargeting these audiences, you can increase the chances of converting them into customers and expanding your audience pool.

With iPinYou Optimus DSP's comprehensive Chinese audience data, your brand can effectively target and engage with Chinese audiences, making it an ideal solution to expand your reach in the Chinese market. Don't hesitate to contact us to learn more about how iPinYou achieve your business goals!